In this article, Insurance Business sheds the light on common queries you may have about life insurance in the UK. Questions such as “What is life insurance?” and “What are the types of policies available?” are among those that we will provide answers to. For the mortgage professionals who make up our core audience, this article could serve as a good reference for any clients of yours who have questions about how life insurance in the UK works.

Just like in other countries, life insurance plans in the UK provide a lump-sum payment to the beneficiaries either at the time of the policyholder’s death or after a set period. This financial benefit has made life insurance one of the most popular forms of coverage in the UK.

Your life insurance policy will remain in-force for as long as you meet your premium payments on time. Depending on the type of plan you choose, your coverage can end after a set term or last a lifetime.

You can likewise pick between two types of cover:

1. Single life insurance policy

This type of life insurance plan covers only one person and pays out the death benefit if they die during the length of the policy, at which point coverage ends. Some couples opt to take out separate policies, so they will still have coverage even after their spouse or partner dies.

Single life insurance benefits are also paid into your estate, allowing you to choose your beneficiaries. We will discuss life insurance beneficiaries in detail later.

2. Joint life insurance policy

A joint policy covers two lives, but only pays out after one person dies, after which coverage ends. The death benefit goes to the surviving partner, unless other arrangements were made.

If a couple with a joint life insurance plan separates, they may be able to convert this into two single life insurance policies.

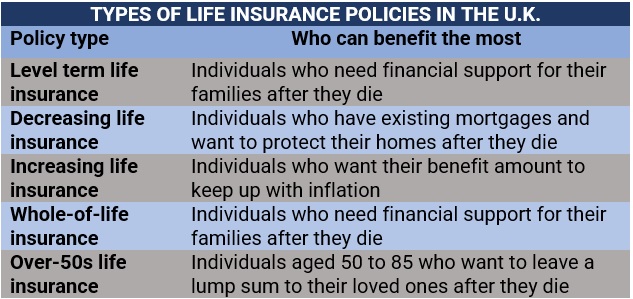

Insurers offer different types of policies, with each offering varying levels of financial protection. In general, life insurance plans in the UK come in two major categories. These are:

1. Term life insurance

As the name suggests, term life insurance policies run for a fixed term. You are free to choose the coverage amount and policy length but bear in mind that your choices have a corresponding impact on premiums. Term life insurance pays out a benefit only if you die within the set timeframe. Otherwise, the insurer keeps all the premiums you paid. Some providers, however, also cover you if you become terminally ill.

If you’re considering taking out term life insurance, there are three types of plans you can choose from. These are:

Level term life insurance: Or simply life insurance, pays out a lump sum if you pass away within the agreed term, with the level of cover remaining the same throughout.

Decreasing term life insurance: This type of policy is often used to pay off your mortgage, that’s why it is sometimes called mortgage protection insurance. The death benefit amount reduces each year to correspond with your loan balance, although your premiums remain the same.

Increasing term life insurance: The death benefit amount in this type of policy increases throughout the plan’s term to keep up with inflation.

2. Whole-of-life insurance

Whole-of-life insurance, also called a life assurance plan, provides lifetime coverage, with the payouts given to your beneficiaries after you pass away. Because of the level of coverage this policy provides, the premiums are also more expensive compared to those of term life plans. One major drawback is that if you live longer than expected, you may end up paying more than what you can get out of the policy.

And just like whole life insurance in the US and Canada, this type of life insurance in the UK sometimes includes an investment element that you can access while you’re still alive and can be sold through financial advisers.

Term life insurance. Whole-of-life insurance. These are just some of the buzzwords you’ll encounter when taking out life insurance in the UK. If you want to know the meaning behind the different life insurance jargon, our glossary of common insurance terms can help.

Over-50s life plan

Not considered a major category, some UK life insurers offer over-50s life plans, which provide coverage for individuals between 50 and 85-years old. Premiums are based on the benefit amount and the policyholder’s age. These plans also offer guaranteed acceptance, meaning applicants are not required to submit medical information. Because of this, rates are often higher as insurers have no way to predict the plan holder’s risk level.

Over-50 plans’ are typically capped at around £20,000. There is also a waiting period that can range from 12 to 24 months. If the policyholder dies due to natural causes within this period, the beneficiaries will not receive a benefit but the premiums they paid will be returned.

Who needs life insurance?

While not everyone may need this form of coverage, there are certain types of individuals and groups who can benefit the most from taking out life insurance. They include:

- Breadwinners

- Parents of school-aged children

- Parents who have dependants with special needs

- Families with existing mortgages

On the other end of the spectrum are individuals who do not need life insurance, including:

- Singles

- Those whose spouse or partner earns enough for their family to maintain their lifestyle

- Low-income earners who can qualify for state benefits

Some employers also offer employee packages that include death-in-service benefits – which work somewhat similar to life insurance – with a coverage amount linked to your salary. That’s why it pays to check with your company to see if you already have cover. However, you may still need to take out a life insurance policy if you feel that the benefits you are eligible for are not enough to sustain your family’s lifestyle after you die.

Another thing to remember is that employee packages are non-transferrable. This means that when you leave your employer, you cannot take the benefits with you.

The table below sums up the different types of life insurance in the UK and who can benefit the most from each.

A pre-existing condition does not necessarily prevent you from taking out life insurance in the UK but there are some additional factors you need to consider. These include:

- The insurance company may require additional medical information: Insurers may require you to undergo further screening and medical examinations to learn more about your condition. Some providers cover the cost of these tests.

- Your premiums may cost more: If you get approved, your insurer may charge higher premiums, depending on the severity of your condition, as you also present a higher risk.

Another option is an over-50s plan, which offers guaranteed acceptance. These plans, however, do not provide the same level of coverage as standard life insurance policies and can even cost higher.

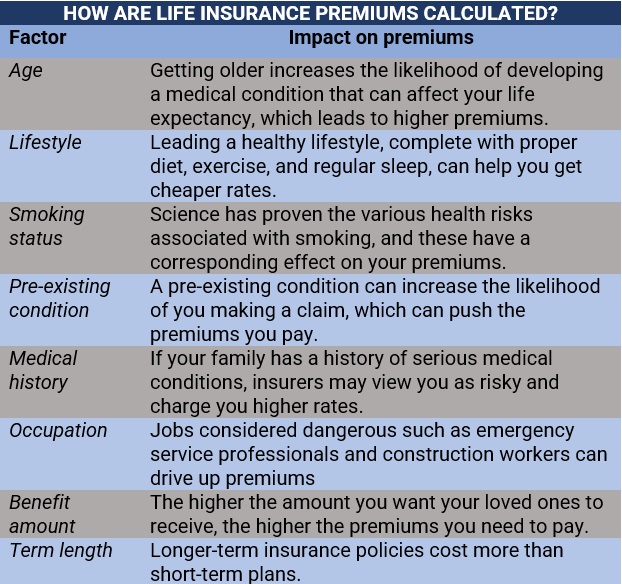

During the application process, your insurer will ask you several lifestyle- and health-related questions to determine your risk level. It is very important for you to answer these questions accurately and honestly, and to disclose any pre-existing medical condition.

Your insurance provider regularly checks the medical information you provided and may contact your doctor for confirmation. If you have been found to deliberately withhold important medical details from your insurer, they may cancel your policy and void coverage.

As the policyholder, you can name anyone as a beneficiary of your life insurance plan. These include:

- Your spouse

- Your common law partner

- Your biological children and stepchildren

- Your grandchildren, including unborn ones

- Your parents

- Your siblings

- Close or distant relatives

- Business partners

- Your friends

- Charitable institutions

You can also name the beneficiaries as an individual or group. If you have a single life insurance plan, the benefits will be paid into your estate, where the beneficiaries are named through your will. If you do not leave a will, the proceeds of the estate will be shared according to the rules of intestacy.

You can likewise name beneficiaries when you place your life insurance in a trust. Doing so has potential benefits, including:

- The benefits will not be counted as part of your taxable estate, meaning the lump sum will be passed on to your beneficiaries exempt from Inheritance Tax (IHT).

- The benefits can reach the beneficiaries faster if there are appointed trustees who will take care of the process after you die.

Because each person’s lifestyle and health status vary significantly, it’s difficult to provide a ballpark figure to represent the cost of standard life insurance in the UK. Premiums are influenced by a range of factors. The table below sums up these parameters and how they impact life insurance rates.

If you want to know how premiums are calculated for different policies, you can check out our comprehensive guide to insurance premiums to learn more.

The answer to this question depends on your personal situation. If you have people who are heavily reliant on you financially, then life insurance can help provide some level of monetary support after you die. Taking out life insurance can also help pay off your mortgage if your beneficiaries do not have the financial capacity to do so.

Not everyone, though, needs this type of coverage. If your wealth is enough to maintain your loved ones’ lifestyle after you pass away, then purchasing life insurance is unnecessary. It’s the same if you are single with no dependents.

If you want to know how life insurance policies work in different countries, you can check out our global life insurance primer.

An experienced insurance agent or broker can give you a rundown of the types of coverage that best fits your personal circumstances. We recommend that you check out our Best Insurance for UK page to find reliable and trustworthy insurance professionals near you.

The insurance companies featured on this page are nominated by their peers and vetted by our team of experts as reliable leaders in the industry. By dealing with these providers, you’ll have the peace of mind of knowing you’re getting the best coverage from someone who can be trusted during difficult times.

Are you searching for the right life insurance plan? Which features and benefits do you think are important? Share your thoughts in the comments section below.