In this article, Insurance Business compiled a list of practical tips and strategies that can help British motorists save on car insurance premiums. Here are 15 of the most effective premium-reduction techniques that can help you land cheap car insurance in the UK. If you are an insurance professional with a client who is worried about the cost of car insurance, this is a good guide to help them.

1. Shop around and compare car insurance rates.

Because premium prices can vary significantly depending on a driver’s personal circumstances, determining which policies provide the greatest savings can prove to be challenging. A car insurance policy that offers the cheapest rates for you may be the most expensive option for another.

This is where price comparison websites can come in handy. The internet is replete with insurance comparison sites that you can easily access. These platforms allow you to shop around and compare quotes from several car insurance providers, which is often the simplest and most effective way to ensure that you are getting the lowest rates possible for the coverage that you need.

2. Skip unnecessary coverages.

Most car insurers offer a range of coverage options that can boost your policy’s protection level – but there’s a caveat. While the increased coverage these add-ons provide makes them very attractive features of your policy, they can also easily drive up the cost of premiums. So, it pays to be aware of the coverage you really need. Often, by sticking to the basics, you can also greatly lower your rates.

3. Read the policy carefully before purchasing.

To avoid overpaying, you should have a clear understanding of what you will be covered for and how much a plan will cost you. This is why it is important for you to carefully read through the policy document before purchasing. Doing so also enables you to get the right coverage at the best possible price. Be sure to double-check the quotes and if the coverage level suits your needs.

4. Maintain a clean driving history.

Keeping your driving record spotless is one of the best ways you can access cheap car insurance in the UK. If you are a safe driver, auto insurance companies often view you as more of an asset as you are less likely to be involved in vehicular accidents and, therefore, cheaper to insure. You may also be able to access a range of discounts for adopting safe driving practices like the one below.

5. Build up your no-claims bonus.

You can also significantly reduce the cost of your car insurance premiums by building up your no-claims bonus. If you have consecutive claim-free years, you may be able to take advantage of this type of discount. The amount can potentially rise each year, with some insurers offering up to 70% to even 80% reduction in premiums for drivers who have maintained their claims-free status for five straight years.

It can also help if you can make smart choices on what you claim. For example, paying for minor repair costs out of pocket if it means retaining your no-claims status.

6. Pick your car wisely.

The type of car you choose plays a huge part in how your premiums are calculated. Pricier vehicles are often more expensive to repair as they have parts that are difficult to replace, not to mention they are also more attractive to thieves, pushing up insurance costs.

In the UK, every vehicle on sale is categorised into a car insurance group, which helps insurers determine how much premiums they will charge. The groups are numbered anywhere from one to 50. As a general rule, the lower the insurance group, the cheaper it will be to have the car insured. We will delve deeper on how car insurance groups work later.

You can also check out our latest rankings to find out which cars in the UK are the cheapest to insure.

7. Avoid costly modifications.

The right modifications can boost your car’s performance and make it more stylish – but these can also drive up premiums. So, if you want to cut down on insurance costs, you should carefully consider first if such enhancements are necessary. Another thing to take note of is that it is mandatory for you to declare any modifications done to your vehicle to your insurer, even if you were not responsible for these changes. Failure to do so risks voiding your coverage.

8. Take defensive driving courses.

Taking safe driving courses not only shows that you are committed to becoming a better driver, but also allows you to qualify for discounts. It would be best though to talk to your insurer before enrolling in courses to know which discounts you could be eligible for. An experienced insurance agent or broker can give you sound advice on the best route to take to qualify for lower rates.

9. Pay premiums annually instead of in monthly instalments.

Paying for your premiums in monthly instalments is like paying for a car loan – you are also likely being charged for interest or finance arrangement fees. If you can afford to, opt for annual payments. This can slash a substantial amount from your car insurance.

10. Install anti-theft devices.

Anti-theft devices play an essential role in boosting your car’s security – and car insurers like that. Most insurance companies will reward you with discounts if you have installed theft deterrents in your vehicle. These include:

- Car alarms

- Kill switches and immobilisers

- Steering wheel locks

- Brake locks

- Locking wheel nuts

11. If you can afford to, consider raising your deductible.

A higher deductible means lower premiums. But this also increases the amount you need to pay before your car insurance picks the tab in the event of an accident or theft. Think carefully and make sure you choose a deductible amount that you can manage to pay. This strategy is not for everyone but if you are a safe and confident driver, you may be able to afford more risks.

Wondering how an insurance deductible works? Find out how in our comprehensive insurance deductibles guide.

12. Be mindful of your mileage.

One of the most common mistakes drivers make that prevents them from getting cheap car insurance in the UK is overestimating their mileage. For example, if you expect to cover 10,000 miles and declare this on your insurance policy, yet only drive 5,000 miles, you’re paying for a wasted 5,000 miles worth of insurance cover. It pays to be as accurate as possible when providing car insurance companies about how many miles you cover. But you shouldn’t be dishonest either as this can result in the rejection of your claims.

13. Park in a secure location.

A car left out on the street is always more vulnerable to theft, vandalism, and damage from careless drivers. This level of risk often leads to higher premiums. Conversely, if your vehicle is parked in a secure location, such as a garage, you can access cheaper rates. Keeping your car garaged also yields other benefits, including keeping your car looking pristine longer as it reduces damage caused by UV radiation, hail, and bird droppings.

14. Consider a telematics policy.

Enrolling in a telematics policy can be beneficial for certain types of drivers. This works with your insurer installing a telematics device in your vehicle. The device, also called a black box, tracks driving behaviour, allowing you to access discounts based on when, how well, and how much you drive.

15. Do not let your car insurance policy auto-renew.

One of the main reasons why many drivers choose to let their car insurance policies auto-renew is that they find the process of shopping around and applying for a new one arduous and time-consuming. But doing so can also make them miss out on a better deal.

According to experts, reviewing coverage and shopping around for a better deal is something that you should practice every year to reduce your premiums or find a policy that you’re happier with. By taking these steps, you can also determine if you’re still getting value from your current cover.

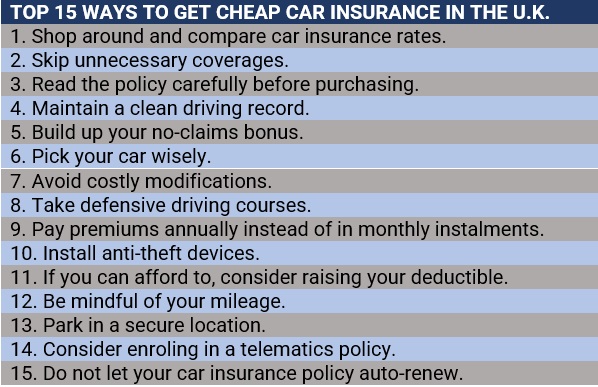

Here’s the summary of the top 15 ways to get cheap car insurance in the UK.

If you’re like most Brits, you probably do not pay too much attention to a vehicle’s insurance group before purchasing. This often-overlooked detail, however, has a major impact on your car insurance premiums.

As mentioned earlier, every vehicle on sale in the UK is categorised into a car insurance group, which helps car insurers in determining how much premiums they will charge. The groups are numbered anywhere from one to 50, with the cars falling into the lower insurance groups getting the cheapest rates.

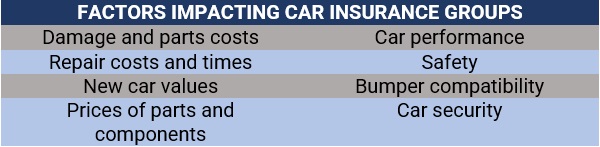

A group rating panel consisting of representatives from the insurance industry and members of the Association of British Insurers (ABI) and Lloyd’s Market Association (LMA) are tasked to determine in which category each car will fall. To do this, the panel considers eight factors, with the goal of finding out how much damage a vehicle sustains in a collision and how cheap and easy it is to repair after an accident. These parameters are listed in the table below.

Our comprehensive guide on car insurance groups can help you work out if your vehicle is eligible for cheap car insurance in the UK.

A vehicle’s insurance group, however, is not the only factor that car insurers take into account when calculating coverage costs. Insurance companies also consider several parameters, including:

- Age: Young and inexperienced drivers are often considered riskier to insure and face higher premiums than their older counterparts. Parents who are thinking about adding their teenage children to their policies should also be aware that doing so can drive up premiums depending on their kids’ driving history.

- Gender: Male drivers are viewed to have a higher likelihood of getting involved in accidents than female motorists.

- Driving record and claims history: Past accidents and claims increase a driver’s risk, which leads to higher premiums. Motorists with a clean driving and claims history, meanwhile, are often rewarded with discounts from their insurance providers.

- Residence: Car insurance rates for postcodes with higher vehicular crime and accident rates will likely be higher.

- Level of coverage: The choice of policy also dictates how much a driver will pay in car insurance.

- Occupation: Some professions present a higher risk for auto insurers, including food delivery and taxi drivers, pushing up insurance rates. Find out which occupations in the UK have the most and least expensive premiums in this article.

- Vehicle’s market value: A car’s age, make, model, condition, and distance travelled also play key roles in calculating premiums. Ever wondered if newer cars are more expensive to insure than older ones? Find out in our new car versus old car comparison.

- Parking location: Keeping a vehicle in a secured garage or monitored car park will likely result in cheaper premiums compared to just leaving it on a public road.

- Add-ons: Adding optional extras such as roadside assistance, widescreen excess, and rental car cover can raise premiums, although some comprehensive policies already offer these types of coverage.

Do you want to know how insurance companies come up with premiums for different policies? Check out our comprehensive guide on insurance premiums to learn more.

UK motorists are now paying £629 on average for their car insurance, a 19% surge in 2022 or equivalent to a £100 year-on-year increase, according to the latest Car Insurance Price Index from Confused.com and WTW. More details in this Insurance Business report.

It is mandatory in the UK for drivers to take out third-party coverage. Getting caught driving without one can result in hefty penalties and may affect your future eligibility for obtaining coverage. Auto insurance, however, goes beyond just liability coverage.

UK drivers can access three types of protection, according to the ABI. These are:

- Third-party coverage: The most basic form of cover, this pays out for injuries or damage you caused other people, properties, and vehicles. This is also the minimum level of cover required for you to be allowed on the road.

- Third party, fire, and theft (TPFT) coverage: This provides the same protection as third-party policies but also covers if your car is stolen or if it catches fire. Some auto insurance providers also require that the vehicles have a security device installed for theft coverage to kick in.

- Comprehensive coverage: This offers the most extensive coverage available. Apart from third party, fire, and theft, comprehensive policies cover the cost of repairing your vehicle after an accident even if you are at fault.

Car insurance is one of the biggest costs associated with owning and operating a vehicle. In the UK – where there are more than 40.8 million registered vehicles, according to the latest vehicle licensing statistics from GOV.UK – drivers are legally bound to carry at least one type of coverage – third-party insurance. But with motorists swamped with options from various providers, finding the right policies that fit your needs becomes a challenging task.

Choosing cheap car insurance in the UK can often be tempting. But you risk losing more, especially if the protection such policies provide is not enough. To get the most out of your car insurance, you must first understand the choices available to you and the level of coverage the different types of policies offer.

For families looking for cheap car insurance, they can check out our latest rankings of the cheapest family cars to insure in the UK. Sometimes, the best way to get cheap car insurance is to start with the actual car that you purchase and then go from there.

Do you think cheap car insurance in the UK provides sufficient coverage? Tell us why or why not in the comment section below.